irs.gov unemployment tax refund status

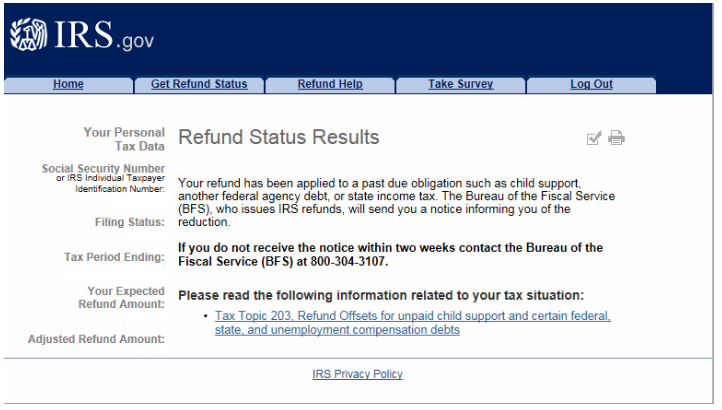

Whether you owe taxes or are awaiting a refund you may check the status of your tax return by. In order to use this application your browser must be configured to accept session cookies.

Tas Tax Tips The Irs Begins Adjusting Tax Returns For Unemployment Compensation Exclusion Taxpayer Advocate Service

- You can start checking on the status of your return sooner - within 24 hours after we receive your e-filed return or 4 weeks after a mailed paper return.

. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. Check Your 2021 Refund Status. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

You can also request a copy of your transcript by mail or through the IRS. Social Security Number 9 numbers no dashes. If none leave blank.

Using the IRS Wheres My Refund tool Viewing your IRS account information. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. The IRS continues to review tax year 2020 returns and process corrections for taxpayers who paid taxes on.

So far the refunds have. Please ensure that support for session cookies is enabled in your browser. In late May the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the American Rescue Plan went into effect.

The IRS will continue reviewing and adjusting tax returns in. Status of Unemployment Compensation Exclusion Corrections. An immediate way to see if the IRS processed your refund is by viewing your tax records online.

Numbers in Mailing Address Up to 6 numbers. Using the IRSs Wheres My Refund feature Viewing the details of your IRS account Making a. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

Refunds Internal Revenue Service

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Heart Of Florida United Way Keep In Mind That Having Tax Withheld From Your Unemployment Benefits Now Will Help You Avoid Owing Taxes When You File Your Irs Tax Return Next

Some May Receive Extra Irs Tax Refund For Unemployment

Irs Issues Another 430 000 Refunds For Adjustments Related To Unemployment Compensation Signals Az

Refund On Its Way 6 Months Later There S Hope R Irs

Irs Backlogs Causing Massive Delays In Processing Returns

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Common Irs Where S My Refund Questions And Errors 2022 Update

Irs Notice Cp42 Form 1040 Overpayment H R Block

Is Unemployment Taxed H R Block

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Irs Says Unemployment Refunds Will Start Being Sent In May How To Get Yours Mlive Com

Tax Topic 203 Refund Offset Where S My Refund Tax News Information

Millions Of Americans Won T See Their Tax Refunds For Months Time