pa estate tax exemption

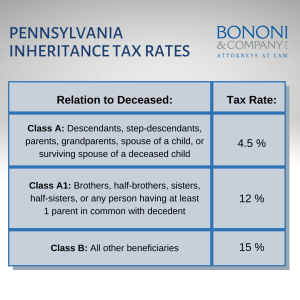

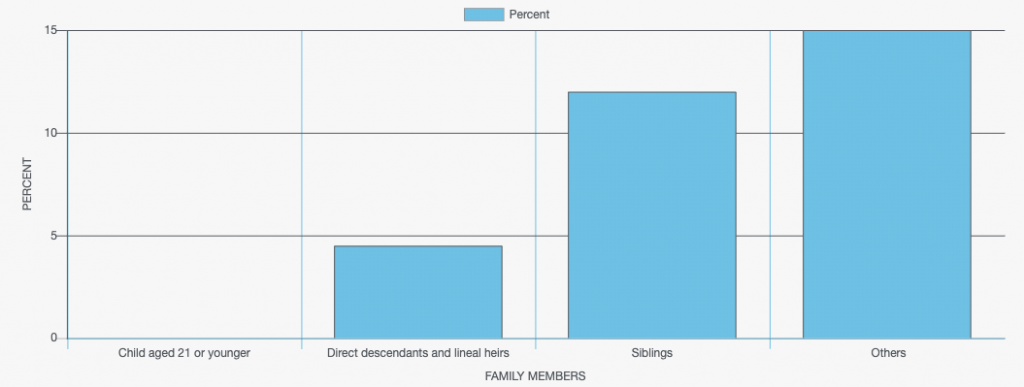

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. 15 for asset transfers to other heirs.

Do I Pay Pa Inheritance Tax If My Relative Lives Out Of State

The Taxpayer Relief Act provides for property tax reduction allocations to be distributed.

. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. Sep 22 2022 0906 PM EDT. Did you know Pennsylvania has a program that provides real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of the commonwealth and.

The tax rate is. REV-1197 -- Schedule AU. Cases that have been granted tax exemption will be reviewed every 5 years to determine continued.

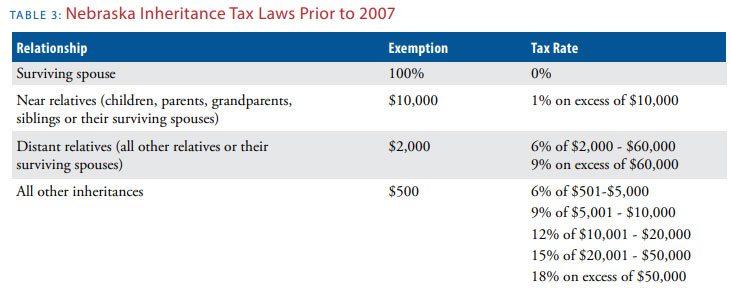

A rate of six percent applied to assets that passed to so-called lineal descendants such as children grandchildren and. Pennsylvania Inheritance Tax Safe Deposit Boxes. The tax rate varies.

1 Organization must be tax-exempt under the Internal Revenue Code. Pennsylvania Department of Revenue Tax Types Sales. REV-714 -- Register of Wills Monthly Report.

In addition to the property tax exemption for veterans Pennsylvania has a Property TaxRebate program that is used to help senior citizens and disabled persons. 45 for any asset transfers to lineal heirs or direct descendants. Doylestown PA 18901 Phone Toll.

FORM TO THE PA DEPARTMENT OF REVENUE. The County Board for the Assessment and Revision of Taxes will grant the tax exemption. Traditionally the Pennsylvania inheritance tax had two tax rates.

An applicant whose gross annual income exceeds 95279 will be considered to have a financial need for the exemption when the applicants allowable expenses exceed the applicants. This tax relief program uses. The tax rate for Pennsylvania Inheritance Tax is 45 for transfers to direct descendants lineal heirs 12 for transfers to siblings and 15 for transfers to other heirs.

A A veteran shall qualify for the real property tax exemption if the following exist. REV-720 -- Inheritance Tax General Information. Property TaxRent Rebate Status.

The Consolidated County Assessment Law 53 PaCS. 2 No part of the organizations net income can inure to the direct benefit of any individual. Estates and trusts are taxpayers for Pennsylvania personal income tax purposes.

Wheres My Income Tax Refund. 8812 provides tax exemptions for second class A through eight class counties which accounts for 65 of the 67. This form may be used in conjunction with form REV-1715 Exempt Organization Declaration of Sales Tax.

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed. 12 for asset transfers to siblings. 1 The veteran has been honorably discharged or released under honorable conditions.

They are required to report and pay tax on the income from PAs eight taxable classes of income that. SCRANTON LACKAWANNA COUNTY WBREWYOU Lackawanna County Commissioners have approved two county real estate. To provide real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of the Commonwealth and has financial need.

Inheritance Tax The Executor S Glossary By Atticus

New York S Death Tax The Case For Killing It Empire Center For Public Policy

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Pennsylvania Inheritance Tax Bononi And Company Pc

Pennsylvania Tax Form 592 Free Templates In Pdf Word Excel Download

Settling An Estate In Pennsylvania

A Comparison Of The Pennsylvania And New Jersey Inheritance Tax Laws

Inheritance Tax How It Works And Who S Exempt Magnifymoney

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Veterans Update February 14 2022 Senator Ryan Aument

How Your Estate Is Taxed Or Not

Bella Hermida Valiente Pa Estate Tax Exemption Increases Due To Inflation For Tax Year 2018 It Was 11 18 Million Rising To 11 40 Million For 2019 And Now 11 80 Million For 2020 Facebook

If The Federal Estate Tax Exemption Is Reduced In The Future Will Your Estate Be Penalized

Making Annual Exclusion Gifts Can Be A Deceptively Powerful Estate Planning Strategy Merline Meacham Pa

Why Retire In Pa Best Place To Retire Cornwall Manor

Death And Taxes Part Ii State Taxes On Pasture

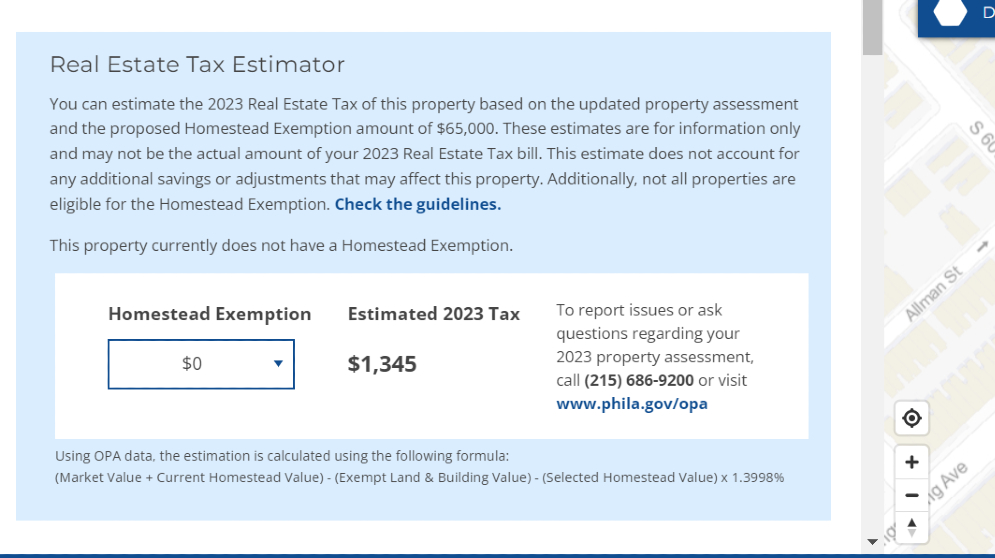

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation