santa clara property tax rate 2021

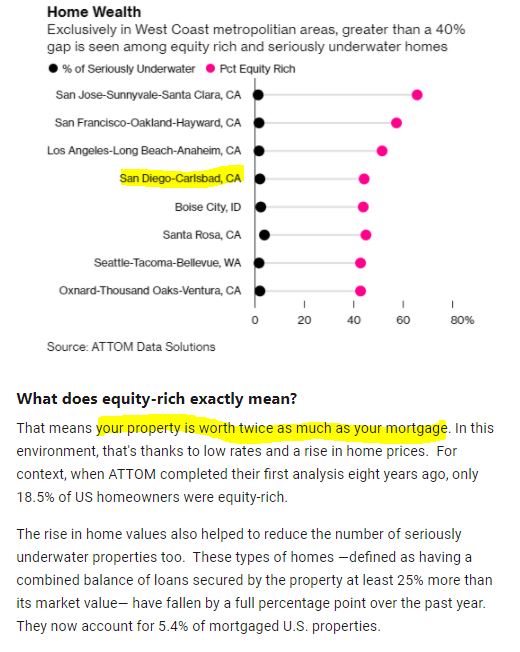

The median home value in Santa Clara County is among the highest in the nation at 913000. This is the total of state and county sales tax rates.

This is the total of state county and city sales tax rates.

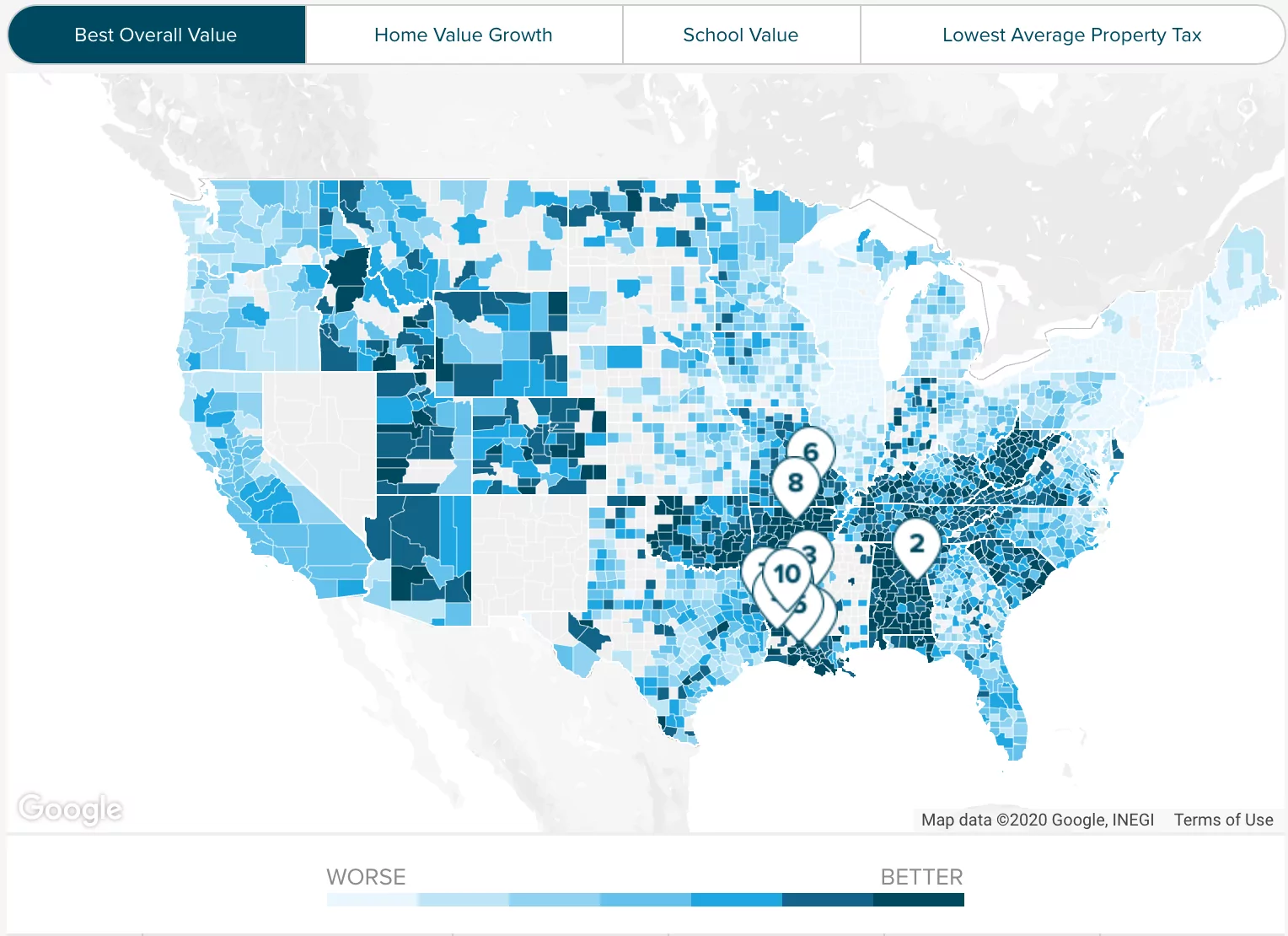

. Learn all about Santa Clara County real estate tax. The average effective property tax rate in Santa. Unsure Of The Value Of Your Property.

It was raised 0125 from 9 to 9125 in July 2021 and raised 0125 from 9 to 9125 in July 2021. Search Valuable Data On A Property. The average sales tax rate in California is 8551.

FY 2020-21 July 1 2020 through June 30 2021 is the tenth consecutive year in which property taxes collected countywide have increased. Browse the Santa Clara CA property tax rates on our Tax Rates tables and find out about low income and tax credits. County of Santa Cruz.

What is the sales tax rate in Santa Clara County. For example a 1000000 home has a transfer tax of 1100. Property Tax Rates.

Tax Rates are expressed in terms of per 100 dollars of valuation. Property Tax Distribution Charts Archive. What is the sales tax rate in Santa Clara California.

Compiled by Edith Driscoll. Santa Clara County collects on average 067 of a propertys. Information in all areas for Property Taxes.

The tabulation below and continued. Proposition 13 the property tax limitation initiative was. Santa Clara County California.

Property Tax Distribution Charts Archive. SANTA CLARA COUNTY CALIF The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022. The County of Santa Clara for the Fiscal Year 2020-2021.

The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of. County transfer tax is typically 110 for every thousand dollars of the purchase price. Tax Rate Areas Santa Clara County 2021.

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination. The principal claimant or the claimants spouse who resides with the claimant. COUNTY OF SANTA CRUZ.

The Santa Clara sales tax has been changed within the last year. Ad Get In-Depth Property Tax Data In Minutes. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

2021-22 Tax Rates. The minimum combined 2022 sales tax rate for Santa Clara California is 913. Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local.

The median home value in Santa Clara County is among the highest in the nation at 913000. Low Value Ordinance The Assessor introduced the low valueminimum assessment ordinance adopted by the Board of Supervisors which provides property tax relief to thousands of small. As mentioned above some.

Santa Clara County California. Ad Get Assessment Information From 2021 About Any County Property. The requirements as of April 1 2021 for Proposition 19 exclusion include but are not limited to.

The tabulation below and continued on the next page represents a summary of the various tax rates levied in the County of Santa Clara for the Fiscal Year 2020-2021. Such As Deeds Liens Property Tax More. The minimum combined 2022 sales tax rate for Santa Clara County California is.

Because of these high home values annual property tax bills for homeowners in Santa Clara. It limits the property tax rate to 1 percent. Start Your Homeowner Search Today.

Santa Barbara campus rate is 775 8750. Find All The Assessment Information You Need Here.

What You Should Know About Santa Clara County Transfer Tax

When Are Property Taxes Due In Santa Clara County Valley Of Heart S Delight Blog

Bay Area Real Estate Recovery Creates Property Tax Appeal Opportunities

Property Taxes Department Of Tax And Collections County Of Santa Clara

What You Should Know About Santa Clara County Transfer Tax

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara

What You Should Know About Santa Clara County Transfer Tax

Property Tax Re Assessment Bubbleinfo Com

Silicon Valley Rents Bearing Down On Low Income Families

Op Ed Who S Exempt From Parcel Taxes In Santa Clara County San Jose Inside

Santa Clara County Ca Property Tax Search And Records Propertyshark

Santa Clara County Ca Property Tax Search And Records Propertyshark

Santa Clara County Ca Property Tax Calculator Smartasset

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara